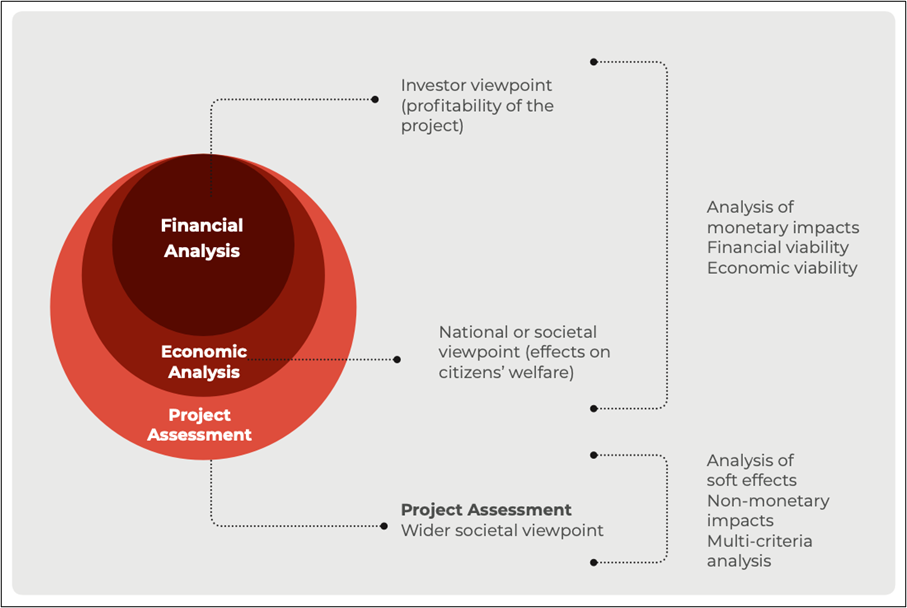

Project Appraisal Approaches

Assessment of investment activities is primal to the deployment of projects, and project evaluation helps to determine the effects caused to foster the best allocation of scarce resources. Project appraisal, also known as project evaluation, can be classified according to the assessment perspective, and therefore the scope of the evaluated impacts. These methods are essential for evaluating the feasibility and impact of projects from various perspectives.

1. Financial Analysis

Financial analysis focuses solely on the investor's perspective, assessing the profitability of a project by examining its monetary impacts. This method evaluates whether the expected financial returns justify the investment made. Cost-benefit analysis (CBA) is the most recognised tool within this category, allowing for a systematic comparison of costs and benefits to determine financial viability.

2. Economic Analysis

Economic analysis broadens the evaluation to include national and societal viewpoints. It considers both direct and indirect monetary impacts, as well as monetisable effects, providing a more comprehensive assessment of a project's economic viability. This approach is often encapsulated in social cost-benefit analysis (CBA), which evaluates how projects contribute to overall societal welfare beyond just financial returns.

3. Comprehensive Project Assessment

This method extends the evaluation further by incorporating soft effects and intangible impacts that are not easily quantifiable in monetary terms. By considering these non-monetisable factors, such as social and environmental impacts, this approach allows for a more holistic understanding of a project's potential benefits and drawbacks 35. By utilising these three appraisal methods, stakeholders can make informed decisions that align with both financial goals and broader societal objectives.

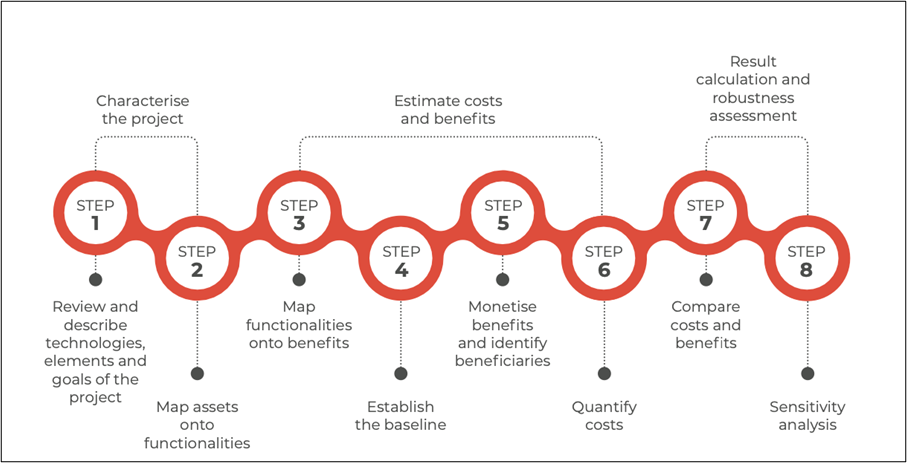

Cost-Benefit Analysis (CBA) for Smart Grids

The European Commission Joint Research Centre’s (JRC) Cost-Benefit Analysis (CBA) methodology consists of three main stages aimed at evaluating a project's viability.

In the first stage, the project is characterised by identifying and detailing its objectives, context, and key technologies. This involves a thorough analysis of the project's environment to establish a baseline and relevant economic parameters, which is crucial for understanding the project's functionality and potential impacts. The JRC guidelines assist analysts in mapping project assets to these functionalities.

The second stage focuses on identifying the potential benefits derived from the project by mapping them to the previously established functionalities. This stage relies on the baseline to define a reference level for quantifying benefits, with JRC guidelines offering recommendations for monetising both positive and negative impacts.

Finally, in the third stage, CBA indicators such as Net Present Value (NPV) are calculated by comparing discounted costs against benefits. Sensitivity analysis is also performed to assess how changes in baseline values and monetisation affect the robustness of the CBA results.

The Scalability and Reliability Analysis (SRA) Bridge Methodology for Smart Grids

The Scalability and Reliability Analysis (SRA) can be conducted across various dimensions, such as the communication and function layers. However, if the analysis scope and procedural steps are unclear, it may lead to ambiguous conclusions. Given the numerous projects funded by the European Commission that incorporate an SRA, establishing a standardised approach is beneficial for sharing and comparing results effectively.

To address this need, the H2020 BRIDGE initiative has developed guidelines and methodologies designed to assist projects in conducting SRAs, regardless of their specific characteristics. These guidelines provide a consistent framework that draws on the collective experience from various projects, ensuring a more uniform application of the SRA process.

The process for conducting a Scalability and Reliability Analysis (SRA) involves several key steps:

1. Define the Scope of the SRA:

Identify which layers and dimensions of the Smart Grid Architecture Model (SGAM) will be analysed. This includes regulatory aspects, economic factors, business models, stakeholder perspectives, functionality, software scalability and replicability, ICT scalability and replicability, and components.

2. Establish Methodology for Each Selected Dimension:

For technical analyses (such as functional and ICT assessments), the methodology typically relies on simulations and emphasises a quantitative approach. This includes conducting sensitivity analyses by varying critical parameters and evaluating a defined set of Key Performance Indicators (KPIs). Conversely, non-technical analyses (like regulatory and stakeholder perspectives) adopt a qualitative approach, often using questionnaires or interviews to gather information for comparisons and to identify potential barriers.

3. Conduct the SRA for Each Dimension:

Execute the analysis based on the defined methodologies for all chosen dimensions.

4. Draw Conclusions and Develop SRA Guidelines/Roadmap:

Summarise findings from the analysis and formulate rules or a roadmap for future SRA applications.

Further Information

Use this handbook to see how these methodologies were applied for use cases in India and Europe.

Smart Grid Replication Handbook (You will be redirected to another site)Access the Investment Analysis Tool developed under the ‘National Smart Grid Mission’

Click Here (You will be redirected to another site)Official Partner

Nodal Agency

Knowledge Partner

Join Our Community

Official Partner

Nodal Agency

Knowledge Partner